Mileage Tracker by Driversnote

Rating: 0.00 (Votes:

0)

Say goodbye to tedious paper mileage logs with the most accurate automatic mileage tracker.

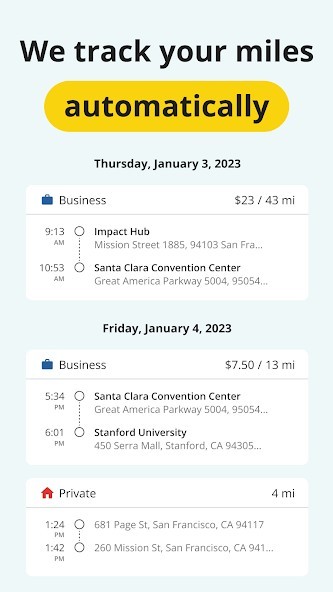

Accurately track business miles and create IRS-compliant logs at the touch of a button.With Driversnote, you get all the reimbursement or deductions you’re entitled to. Join over 1,7 million drivers and simplify mileage tracking to just 3 steps: Track, Classify and Report!

🕒Claim your time back. Our mile tracker saves you hours of manually logging journeys. The app records all the information you need in real time.

😌Tax time isn’t a headache anymore. Effortlessly get tax-compliant mile logs of your work-related driving for reporting to the IRS.

🗂️Be the most organized employee. Create and send your trip logs to your employer in a matter of seconds.

🧾Tax audit coming up? Access your previous and current log books anytime, anywhere.

📧 World-class support Simply send an email to our brilliant Support team with any questions and they’ll get back to you.

The only mileage tracker you need as a business, sole trader, employee, employer, or just about anyone who drives!

🚘1. TRACK

• Track trips completely automatically - the car mile tracker will start recording once you reach a certain speed.

• Want to record an individual trip? Just tap START and STOP and leave the rest to our smart GPS automatic mile tracker.

• Effortless odometer tracking.

• Forgot to track travel during the day? Enter the start and end addresses of your drives and the app will do the rest for you.

• Further improve automatic trip tracking - place an iBeacon in your car and Driversnote will record only your preferred vehicle's miles every time you enter or leave your car. Get a free iBeacon when you sign up for the annual Basic subscription.

✅2. CLASSIFY

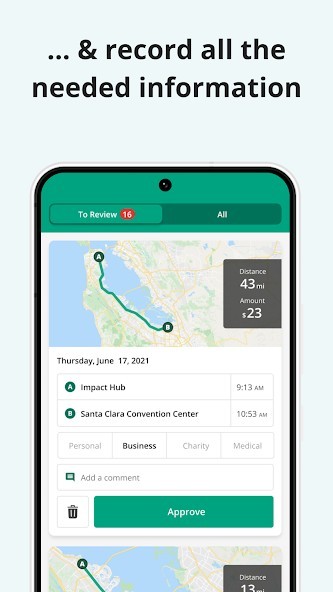

• Categorize each trip as Business, Personal, medical or Charity for a compliant driving log

• Set your working hours for automatic classification of trips as Business and Personal

• Add notes to your recorded journeys

• Review your trips at a glance and easily edit details

🗒3. REPORT

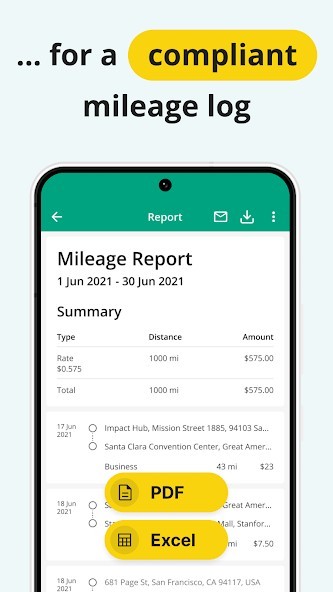

• IRS-compliant reports for your employee reimbursement or car expenses tax claim

• Claiming deductions by the actual expenses method? Use the percentage split to report on the percentage of miles you traveled for work

• Create separate logs for separate vehicles and workplaces

• Choose if you want to show odometer readings

• Have your reports include the total miles, start and end dates, distance, reimbursement amount or % split between business and personal driving

• Get your vehicle log books in PDF or Excel, or send them directly through the app

🖥️Driversnote for Web brings all the functionality to your Desktop

• Review your logs and edit details easily

• Add trips you forgot to record

• Generate your mileage reports

✔️Always convenient - features that will keep you on top of your logbook

• Customize your reimbursement rate if it’s different from the one the IRS sets

• Set reporting reminders so you never forget to report your miles

• Save addresses you visit often

💼Driversnote for Teams - perfect for company reimbursement programs

• Invite and remove users

• Employees use the automatic mileage tracker

• Employees create & share consistent logbooks with their managers

• Managers review and approve mileage expense claims in one simple overview

• Privacy - managers can only see the trips employees report

🔒Privacy by design

• We never sell data

• We will never provide your information to other parties for marketing purposes

• See more in our Privacy Policy

🙋Support

• Looking for a quick answer to your question? Visit our comprehensive Help Center straight from the app.

• Our efficient and effective Support team is ready to assist you at any time at [email protected]

User ReviewsAdd Comment & Review

Based on 0

Votes and 0 User Reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

Other Apps in This Category